Re: Those Darn Gas Prices

An interesting discussion regarding speculation of pre-election gas price manipulation has developed in the comments at Toner Mishap (I'm sure it is going on elsewhere) where Dr. Steven Taylor of Poliblog, posted his latest argument that the price of domestic gasoline is purely a function of falling futures oil prices on the world market. This, of course, is exactly what the oil industry, including OPEC and major oil producers such as ExxonMobile, BP, etc., expect that we should believe. They all further claim that they cannot possibly manipulate oil futures trading of this commodity. I'll first offer some evidence that this later claim is, at best, naive, before discussing gasoline prices.

While I initially argued only that oil companies have very tight control of the price of gas as it is charged in the US, it is commonly claimed that oil companies simply cannot influence the world market. This seems reasonable on its surface but further reading suggests that, indeed, oil companies have engaged in market manipulation on the world stage. In fact, Wharton School alum and former commodities trader, Raymond Learsy, informs us that BP has already been caught in the act and agreed to a financial settlement with the New York Mercantile Exchange (NYMERC) in order to quash allegations of improper trading activity:

The settlement cited so-called wash trades-- the simultaneous swaps of the same amount of a commodity for the same price. The technique is used to improperly boost trading volumes or revenue and, most significantly, to influence market pricing.Learsy further elucidates with other of BP market manipulation tales. A lawsuit was filed by the Commodity Futures Trading Commission in Chicago, alleging price manipulation of the propane market. In short, oil companies have engaged in market manipulation. This really should not surprise us. If the Enron debacle taught us anything, it should be the lesson that corporations can and will manipulate markets and specifically energy markets, and construct some rather elaborate mechanisms to do this. Learsy points out that the reason this can happen is that futures trading is entirely opaque; no one knows who is buying and selling in the futures oil market and that this is only a recent phenomenon.

Transparency is key to a realistic assessment of the oil market.And transparency is simply not a feature of futures oil trading in the world market.

Previously, oil was traded on a "wet barrel' basis, that is, on the actual current supply of the commodity and its extant demand. Now and for the last few years, oil, among other commodities, has been traded on future expectations rather than "real" conditions. Imagined future expectations are simply another term for speculation and it is well known the distortions that speculation can introduce to a market because within a paradigm of speculation trading, rumour and innuedo can have a far more effective role than actual forces of supply and demand. We have not seen an actual shortage of oil on the world market -- OPEC's president Edmund Daukoru claimed plenty of spare capacity as recently as July -- yet the price went up and up. Until it didn't. So what changed?

Various specious arguments have been offered, namely that there has been a "stabilization of the political situation in the Middle East," as though the mere cessation of hostilities between Israel and Hezbollah imparted some magical calm on the region. Various pundits still agitate for attacks on Syria and Iran and Iraq continued its swirl down the political drain, with close ties between Tehran and Baghdad further manifesting themselves while it has recently been seen that Baghdad needs to be walled off from the rest of the country. I don't know which "Middle East" is being referred above, but surely it is not the one on planet earth.

This recent price decline is also odd considering that many market observers such as Goldman Sachs, had been imagining a $100+ barrel of oil in the near future. Iran's deputy oil minister, Hadi Nejad Hosseinian, also echoed this sentiment, citing "geopolitical factors" and that "global demand for oil was much higher than supply", which directly contradicted the statements of the OPEC president. Or perhaps not, since the "supply" is strictly controlled by OPEC. What is clear from all this is that there is nothing clear about why oil prices are now falling when almost everyone expected them to increase further.

*********************

On the issue of gasoline prices, Dr. Taylor offers up the standard DoE chart of the price composition of a gallon of gasoline and further cites a comparative chart showing the price of oil and the price of gasoline to refute claims that gas pricing might be manipulated. While the macro trend is clear and indisputable, at smaller scales, the graph itself illustrates exactly what I had pointed out: short term gasoline prices can spike and drop significantly and asynchronously relative to the price of oil. Also, the price of oil in futures trading has seen a decline of about 18% in the last few weeks. During this same time, the price of gasoline has dropped precipitously by 33%. Oil and gas prices, while obviously correlated, are not as tightly coupled as suggested by Dr. Taylor, which is what had been argued earlier.

The gas pump chart, cited by Dr. Taylor, has also been addressed by Robert Learsy and, in doing so, disabuses us of the notion that the majority of the gasoline price is due to the profitless price of oil, as though oil companies make no money off the price of oil itself.

The gas pump chart, cited by Dr. Taylor, has also been addressed by Robert Learsy and, in doing so, disabuses us of the notion that the majority of the gasoline price is due to the profitless price of oil, as though oil companies make no money off the price of oil itself.The oil companies profess that they make only 8.5 cents on a dollar of gasoline. What is brushed over is that the major players in the industry aren't simply refiners or distributors, but they are major producers of crude oil as well, so that the "global price of oil" that constitutes 54% of a gallon of gasoline offers these companies their core profit base and not the sales price of gasoline....What is utterly glossed over in this chart is that companies such as ExxonMobile, Total, BP and other major producers plan oil production, i.e. so-called "installed capacity," on the basis of very low world prices. How low?

In June 2000 Thierry Desmarest Chairman of France's oil giant Total, declared that his corporation would not invest in finding any oil that would be unprofitable at $13/bbl. Desmarest was certainly reflecting accepted wisdom in the oil patch at the time.But new capacity is more expensive and since 2000, oil producers plan on capacity now based on $25/bbl oil. But the older, cheaper installed capacity still exists, pumping out $70/bbl oil when acceptable profit is realized at $13/bbl. Averaging the two profit thresholds is $19/bbl. Assuming a nominal profit margin of 8.5% at $19/bbl, this means that, of the claimed 52% "cost" of oil in gas prices -- the real cost of the installed capacity to produce that oil amounts to 13% of the price of a gallon of gasoline. As Learsy notes, this amounts to "earnings of 368% on every dollar in crude oil equivalent sales."

What this is meant to demonstrate is that the actual costs of production for oil companies is fixed, and fixed at a very low level, while most of the crude price is realised as profit, not cost. With such a large, slushy profit margin, clearly, there is room for oil companies to set gas prices. And we know they do this. As a putative "independent dealer," just ask any franchised gasoline station whether they are able to set their own price.

But the larger question that spurred all of this discussion is, can or would oil companies dictate domestic gas prices on the eve of an election that is clearly threatening the Republican majorities in Congress, majorities that have been unbashedly generous in their treatment of the oil industry. Recently, we've seen the GOP-led House block any legislative attempts to increase oil company tax bill. And the House "energy" bill contained a number of tax breaks, give aways and liability protections. In the aftermath of Katrina, one of the first things Bush advocated was a environmental regulation free zone for oil companies, ostensibly to loose them of bureaucratic encumberances so that they might better and more quickly recover lost production capacity.

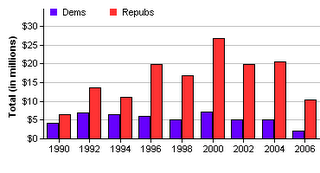

In return for all this treatment, oil companies have indeed been generous, lavishing Republicans with campaign contributions, this year giving five times the money to the GOP than what Democrats have received so far in 2006. As this graph of political campaign contributions shows, the oil industry is hughly biased toward the GOP and has been for sometime, especially since Republicans won the House majority in 1994.

In return for all this treatment, oil companies have indeed been generous, lavishing Republicans with campaign contributions, this year giving five times the money to the GOP than what Democrats have received so far in 2006. As this graph of political campaign contributions shows, the oil industry is hughly biased toward the GOP and has been for sometime, especially since Republicans won the House majority in 1994.We also know that oil company executives are not above lying to Congress about their involvement with Dick Cheney and his Energy Task Force, an episode demonstrating that oil futures trading is not the only aspect of the energy business that is "opaque." In short, it is simply not possible to believe that oil companies do not have a vested interest in seeing Republicans maintain that party's congressional majorities.

Given that we know energy companies have manipulated energy markets and given the enormous profits and fine treatment said companies have enjoyed under the governance of the Bush administration and a Republican Congress, it strikes as mere naivete to think that gas prices are somehow out of the control of oil companies. It seems even more so to think them incapable of this sort of behaviour. Oil companies have demonstrated a remarkable capacity for malicious corporate malfeasance throughout the history of the age of oil. Nothing about this history is the slightest bit suggestive that oil companies are above adjusting circumstances in the short term to their advantage. And one of their advantages is a Republican-led majority in Congress. Besides, tweaking gas prices before an election would one of their lesser egregious behaviours.

Yes, this is speculation. "Wild accusation"? Hardly.

__________________

Further reading about the price gouging, profiteering and suspected market manipulation by OPEC and others, Raymond Learsy's series of articles:

A Funny Thing Happened on the Way to the Gas Pump, 1.15.2006

OPEC Agonistes, 1.29.2006

As Oil Prices Rise the Media Slumbered Away, 4.25.2006

Gasoline Over $3.00 Gallon, Why? BP Knows. 7.12.2006

The Enron Loophole ...., 7.20.2006

The Price of Oil is Falling and the Oil Patch Drums Are Beating, 8.18.2006

Deception From America's Oil & Natural Gas Industry, 8.27.2006

5 Comments:

This is a very interesting and enlightening discussion. Thank you for your insight. Also, I appreciate reading Dr, Taylor's comments. Because of my natural suspicions toward corporations and human greed, I tend to find your argument a bit more persuasive. Let’s face it the oil companies have been trying for years to pump up the prices on gas to keep up with inflation over the years and until the Bush administration got into office, they were not able to or dared not raise the prices so high.

The Oil Companies disgusting profit margin depends on a Republican pres and majority. They will raise them after the elections using any of a host of excuses: meterological, political, production problems, etc..

Plus the gas-station owners raise their prices when the market farts, since they are trying to cover the next batch of gas they purchase. They make the least of all in this chain,since they would be charged with gouging easier than the Oil Companies, on the state level. Their profit margins are pretty tight.

If the oil companies were manipulating the price of oil I'm sure our government will step in and get them with anti-trust laws. Well, unless government was comprised of "oil men".

Boy, if that were the case we'd be screwed.

i couldn't keep up with all this complicated stuff so i went to the free dictionary to look up some words and you wouldn't believe what i discovered:

cartel n. 1) an arrangement among supposedly independent corporations or national monopolies in the same industrial or resource development field organized to control distribution, to set prices, to reduce competition, and sometimes to share technical expertise. Often the participants are multi-national corporations which operate across numerous borders and have little or no loyalty to any home country, and great loyalty to profits. The most prominent cartel is OPEC (Organization of Petroleum Exporting Countries), which represents all of the oil producing countries in the Middle East, North Africa and Venezuela.

what does it all mean?

Hi Mash,

The entire argument presented by Taylor and the crowd who thinks that oil is traded in a "free market" is based upon the naive conceit that an international cartel that was organized to strictly control the production and price of oil cannot control the price of their product is, to say the least, bizarre.

Post a Comment

<< Home